Understanding the drivers of eGrocery success

Online grocery shopping consumer behavior post-pandemic.

In this report, Mercatus provides results of a recent 40,000+ grocery customer survey conducted with Incisiv Research to investigate U.S. online consumer behavior and preferences. With the support of regional grocers across the United States, we surveyed consumers on their views relating to:

- Their retailer of choice

- Online buying preferences

- Preferred product categories

- Changing modes of order fulfillment

Over 40 million data points were collected and analyzed, resulting in an aggregated insights report that includes comparison with 2020 data to understand the year over year change in online grocery customer behavior and outlook.

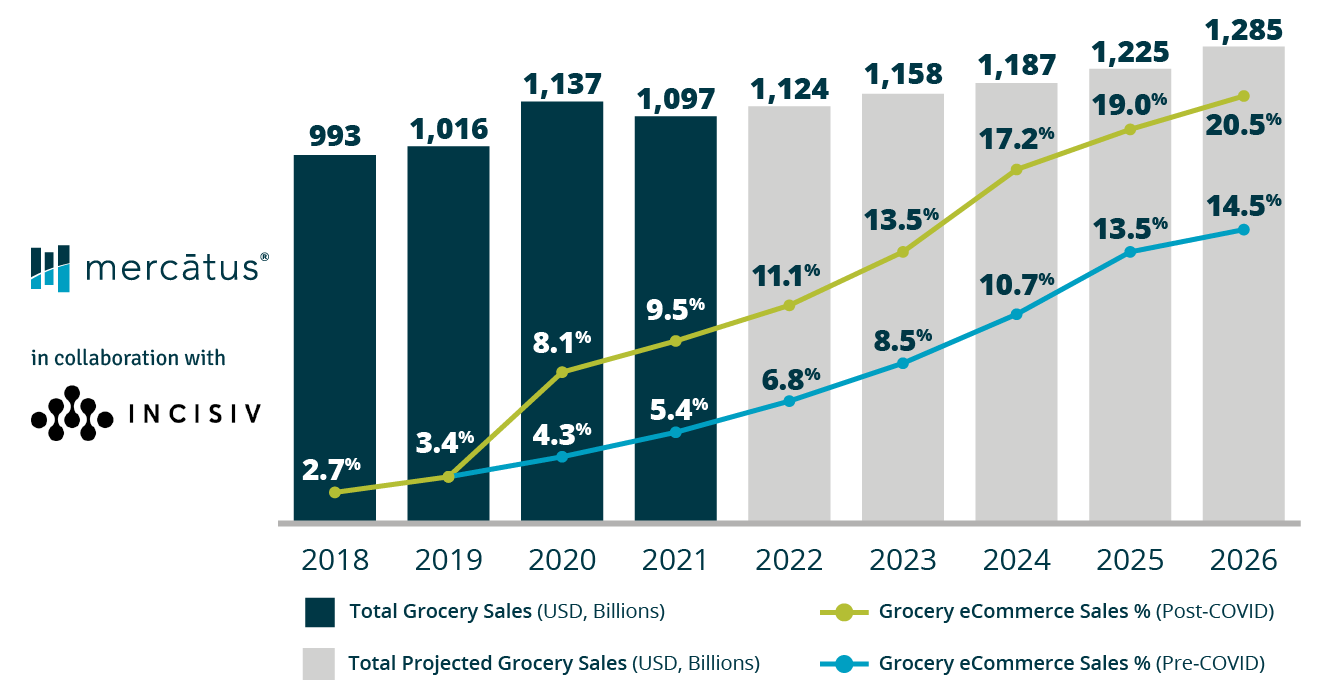

The 2021 survey also includes an updated online grocery market projection using a stochastic forecast algorithm that includes 150+ consumer behavior and preferences attributes, along with demographic, economic, and market factors compiled by Incisiv Research.

Source: Mercatus

Click for Disclaimer

CAGR for Digital Grocery (2021-2026) was computed using a custom causal regression algorithm, taking the following as inputs:

1. Overall Grocery sales (historic) and projected growth

2. Historic share and growth of online grocery

3. Incremental sales of online grocery and growth post COVID

4. Consumer preferences by demographic band

5. Overall Demographic mix

6. Digital maturity of grocery retailers

Note: The 2020 projection of grocery’s digital share was predicted at 21.5%. This number has been revised lower and digital channel revenue is now projected to reach 20.5% by 2026 as U.S. consumer adjust to returning to brick and mortar stores.

In 2021, we saw the surge in eGrocery adoption settle into an ingrained habit for shoppers. Grocery retailers have rapidly scaled their eGrocery offerings to meet initial demand.

But now, as shoppers become more comfortable with grocery eCommerce, their expectations around the experience have changed. For grocers to successfully retain shoppers online, they need to adjust their offerings to meet those expectations.

In this year’s online grocery customer behavior report, we uncovered key insights to help grocery retailers understand the new and evolved grocery customer. Major themes that emerged from the survey were:

- U.S. online grocery is predominantly a grocery pickup experience

- Grocery delivery is expected to shrink below pre-pandemic levels

- Minority households represent the highest value online customers for grocers

- Mobile use will grow another 14% next year

- In 2022, online grocery will be 11% of overall grocery sales and 20.5% by 2026

Dig into these insights and more by downloading the latest shopper survey report, eGrocery Transformed: Market projections and insight into online grocery's elevated future.

"Pickup works particularly well for both grocers and their customers in the North American market. Pickup services offer grocers more control over the cost to serve online customers than third -party delivery. Online customers love the precision, flexibility and overall convenience that store pickup provides. And when done well, pickup services make for a better overall shopping experience that builds lasting connections with customers, which will lead to repeat business for grocers."

- Sylvain Perrier, President & CEO, Mercatus

Looking for more insights? Access last year’s report, eGrocery’s New Reality: The Pandemic’s Lasting Impact on U.S. Grocery Shopping Behavior.

Mercatus is committed to helping grocery retailers to operate and control their own eCommerce experience, with a highly profitable customer-centric growth strategy. Empowering grocers to adapt to today’s changing consumer demands with an end-to-end enterprise-grade SaaS platform.

P: 416.603.3406

T: 1.877.525.5051

F: 416.603.1790